In our previous blog we discussed market uncertainty and how the price per share of public companies ebbs and flows. While some experts may try to time the market and buy at the lows and sell at the highs, it is an extremely difficult task to accomplish. Even the best investment companies in the world struggle to time the market correctly. For most investors, utilizing dollar-cost averaging has been a trusted investment strategy for those that have a long-term investment approach.

So, what exactly is dollar-cost averaging? It is the practice of investing a fixed dollar amount on a regular basis, regardless of the current share price. If you are currently investing in a retirement plan at work, or into an individual retirement account (IRA), or many other investment accounts, you are likely already doing this. Many investors set up a recurring automatic investment amount when they create their accounts. This approach has many benefits. First, it builds good investing habits by automatically sending the money into your investments before it can be spent on other discretionary items. Secondly, it can lower stress by avoiding the emotional rollercoaster of trying to time the market. Furthermore, it helps build a longer-term investment mindset that is focused on larger goals, besides short-term moves.

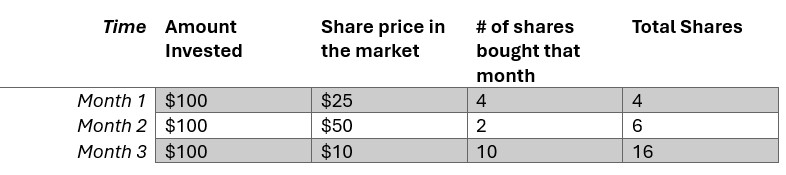

Here is a basic hypothetical illustration of dollar cost averaging. In the example below the investor deposits $100 a month into a mutual fund. In this example, with price per share fluctuations over three months, at $300 invested with 16 shares, the investor’s average cost per share is $18.75 ($300/16=$18.75). If you had tried to time the market and bought in the first couple of months, your price per share would have been higher. Clearly, this is just one example, and sometimes you can get lucky and buy at the bottom of the market. However, that is difficult to replicate over a long-time horizon.

Dollar-cost averaging can also help manage the emotions of investing extra money as the result or an inheritance, bonus, or a large sale. It is common for people to sit on this money because of the fear of losing it if the market falls. Collaborating with your advisor to set up a re-occurring deposit into the market can help facilitate the transition. However, studies have shown that lump-sum investing, which is putting all the money to work as soon as you have access to it, typically outperforms dollar-cost averaging when the investment is kept in the market for one year or more. For further information regarding this study, here is the link to Vanguard’s research: https://investor.vanguard.com/investor-resources-education/news/lump-sum-investing-versus-cost-averaging-which-is-better

The article mentions the emotional benefits of dollar-cost averaging and how it is preferable than holding on to cash for too long and missing potential market gains. Finally, if you would like to take advantage of dollar-cost averaging, give us a call at Laws Financial today!

Disclosures:

1) Dollar Cost Averaging does not assure a profit or protect against loss in a declining market and involves continuous investment in securities regardless of fluctuating prices. An investor should consider his/her ability to continue investing through periods of low-price levels.

2) This hypothetical example is for illustrative purposes only, and its results are not representative of any specific investment or mix of investments. Actual results will vary.